Payment invoice

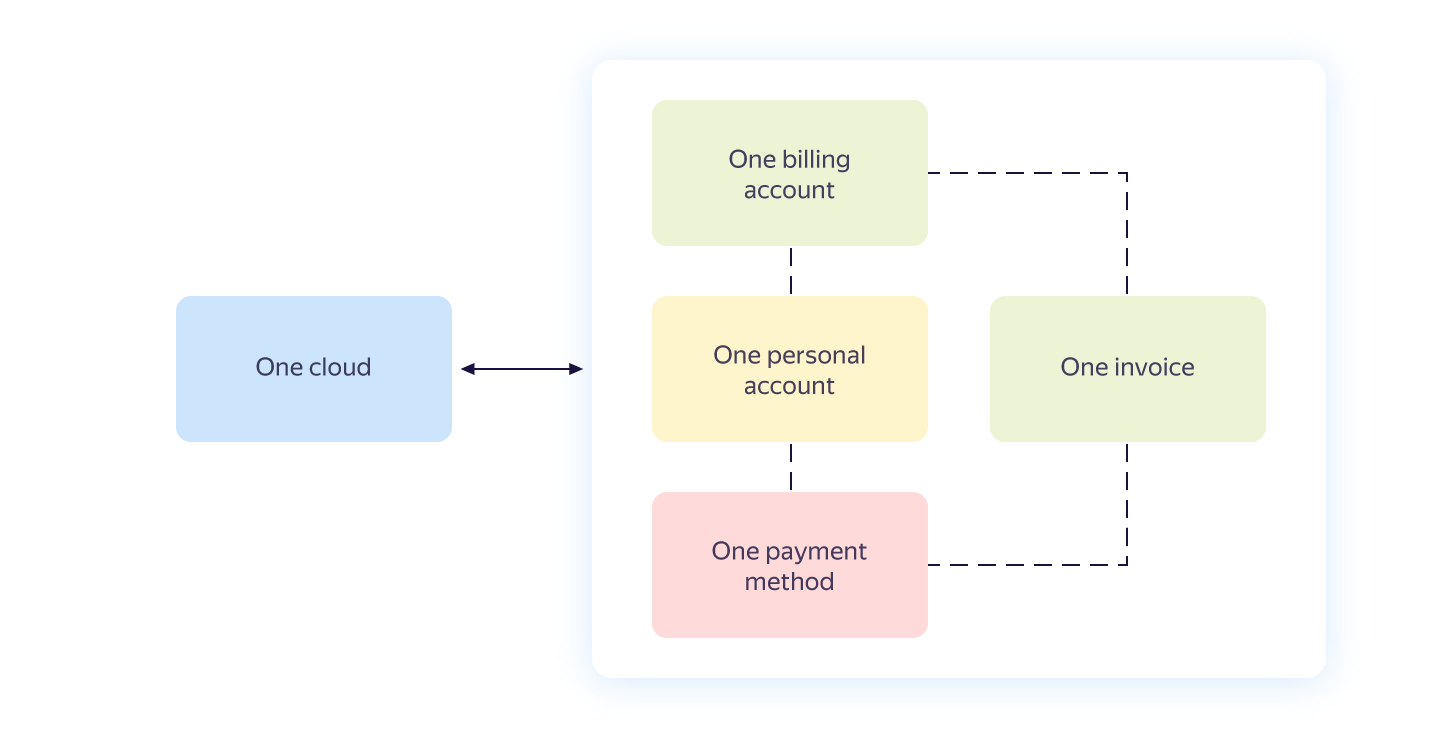

A payment invoice is a document issued for you to pay for the resources consumed. A payment invoice is issued in your billing account and contains aggregate data on all the services used within a single cloud.

The relationship between the payment invoice, billing account, and cloud is shown in the diagram below.

Issuing a payment invoice

A payment invoice is generated automatically and issued at the beginning of the following reporting period under the conditions below:

- The selected payment method is Transfer from bank account.

- Total invoice amount is greater than zero.

Payment invoices are sent only to the email address of the user who created the billing account. You cannot change the email address but you can configure message forwarding. For more information, see Yandex Mail Help

Note

Yandex Cloud reserves the right to issue a payment invoice during the current reporting period if your personal account is in arrears.

Customers qualifying as a business and not using a linked corporate bank card to top up their account must generate a payment invoice via the management console by themselves. Depending on which company you contracted with, you can find detailed information in the Legal Documents section for Iron Hive doo Beograd (Serbia)

A payment invoice is not a primary accounting document. There are no special legal requirements for drafting this document. In accounting, correct charges for services are made based on reports and tax invoices where all the required details are specified. A payment invoice is generated automatically and there is no way to change customer data.

Invoice amount

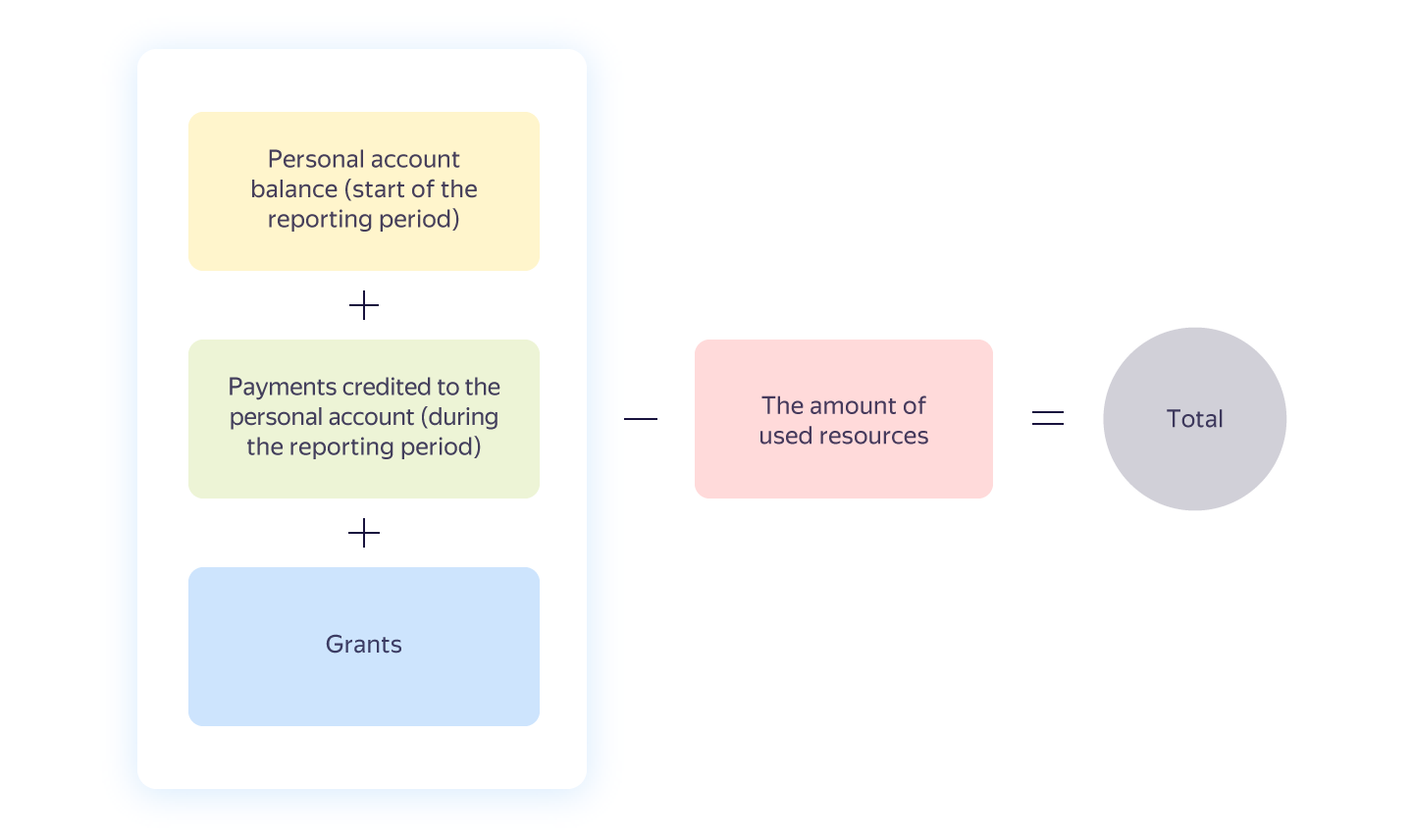

The total payment invoice amount depends on whether you have used your grant and topped up your personal account balance during the reporting period.

The payment invoice amount is calculated using the formula:

Making payment

Invoices must be paid before the deadline set out in the agreement. Payment is made by bank transfer. For more information, see Payment methods for businesses.

Note

The payment invoice must be paid from a bank account opened for the business or individual entrepreneur that the billing account was registered for. Within a single user account, all payers must pay in the same currency.

Payment invoice details

| Name | Description |

|---|---|

| Payment invoice number | Unique payment invoice ID |

| Date of invoicing | Date when the payment invoice was generated in Yandex accounting system |

| Customer | Billing account owner |

| Phone | Phone number of the billing account owner |

| Name of the product, work, or service | Information about the provided services |

| Total | Total amount for all lines of the payment invoice, excluding VAT, in rubles |

| Total VAT % | Amount of accrued taxes for all lines of the payment invoice, in rubles |

| Total amount payable | Total amount for all lines of the payment invoice, including VAT, in rubles |

| Due and payable | Total amount for all lines of the payment invoice, including VAT, in rubles |

| Name | Description |

|---|---|

| Payment invoice number | Unique payment invoice ID |

| Date of invoicing | Date when the payment invoice was generated in Yandex accounting system |

| Customer | Billing account owner |

| Phone | Phone number of the billing account owner |

| Name of the product, work, or service | Information about the provided services |

| Total | Total amount for all lines of the payment invoice, excluding VAT, in tenge |

| Total VAT % | Amount of accrued taxes for all lines of the payment invoice, in tenge |

| Total amount payable | Total amount for all lines of the payment invoice, including VAT, in tenge |

| Due and payable | Total amount for all lines of the payment invoice, including VAT, in tenge |

| Name | Description |

|---|---|

| Invoice No | Unique payment invoice ID |

| Personal Account No | Your personal account number |

| Customer agreement No | Agreement number and date of signing |

| Invoice Date | Date when the payment invoice was generated in Yandex accounting system |

| Payment Terms | Terms of payment |

| Due Date | Deadline for the invoice payment |

| Description | Information about the provided services |

| Amount | Total amount for the provided service, in US dollars, excluding taxes and fees |

| Total | Total amount for all lines of the payment invoice, in US dollars, excluding taxes and fees |

Taxes and fees

In the billing account, one can view the service statistics with or without VAT.

The VAT amount in rubles is added to the cost of services in accordance with the tax law. In the payment documents and documents confirming the provision of services, the VAT amount will be shown as a separate line.

In the billing account, one can view the service statistics with or without VAT.

The VAT amount in tenge is added to the cost of services in accordance with the tax law. In the payment documents and documents confirming the provision of services, the VAT amount will be shown as a separate line.

Taxes and fees of the country of registration of a non-resident legal entity of Russia and Kazakhstan are not added to cost of services on the usage details page or payment invoice total.

Non-residents of Russia and Kazakhstan must pay all the taxes and fees themselves under the laws of their country of residence.