Payment receipt

In accordance with Russian Federal Law No. FZ-54 on Use of Cash Registers

A payment receipt is a primary accounting document confirming the transfer of funds using a bank card.

We recommend that you keep all your payment receipts, as this will help you if any problems with payments occur.

Amount of receipt

The payment receipt amount is equal to the amount debited from the bank card linked to your account.

The total debited amount depends on whether you have used your grant and topped up your personal account balance during the reporting period.

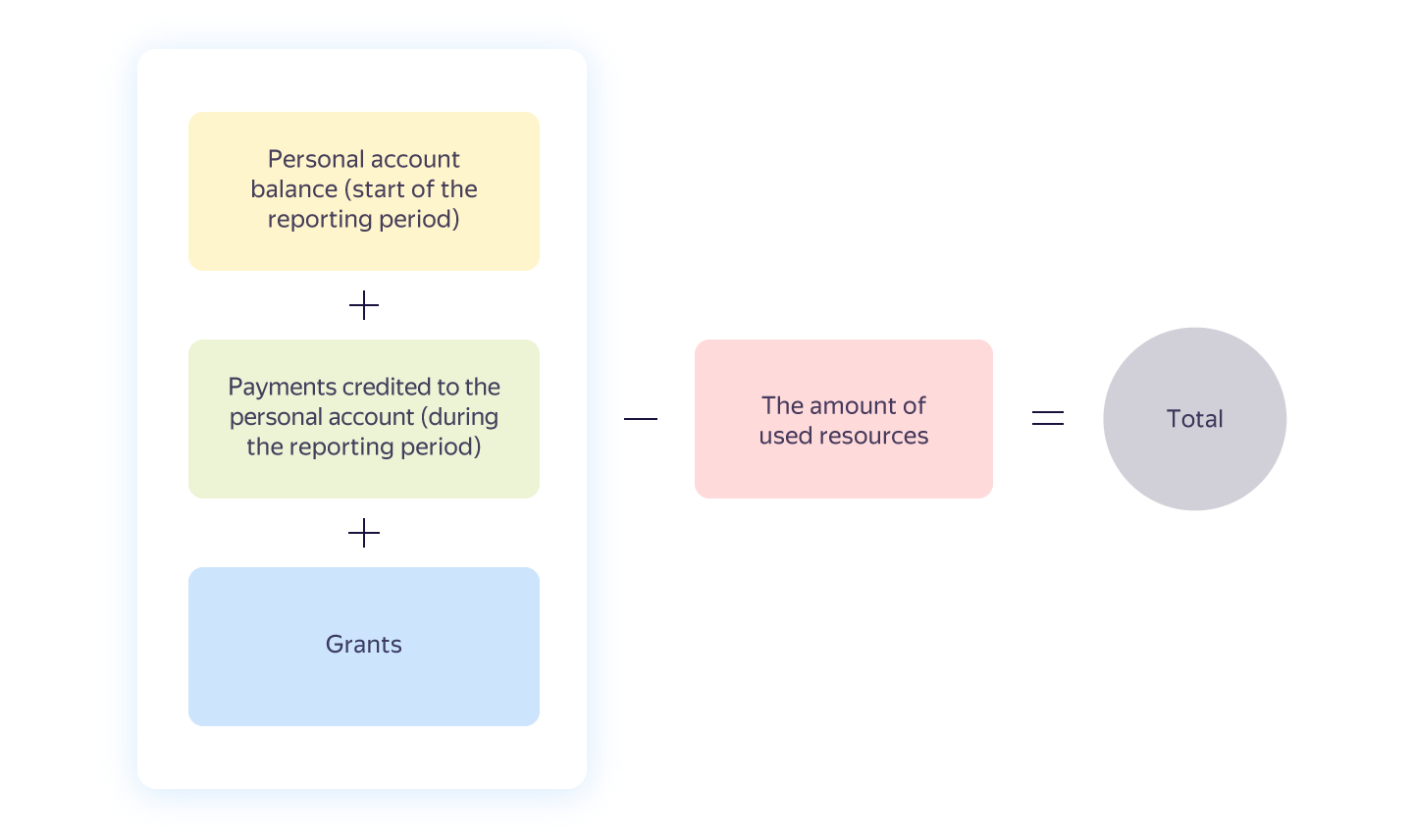

The write-off amount is calculated using the formula:

The personal account balance at the beginning of the reporting period is 0 rubles.

During the reporting period, the account was topped up by 0 rubles.

The grant amount is 1,000 rubles.

The billing threshold is 2,000 rubles.

In the middle of the reporting period, the billing threshold is reached and the amount of consumed resources is 3,000 rubles.

Total amount: 3,000 - (0 + 0 + 1,000) = 2,000 rubles.

In the middle of the reporting period, 2,000 rubles will be debited from the linked bank card. A payment receipt will also be generated for 2,000 rubles.

The personal account balance at the beginning of the reporting period is 0 rubles.

During the reporting period, the account was topped up by 0 rubles.

The grant amount is 1,000 rubles.

At the end of the reporting period, the amount for consumed resources is 800 rubles.

The grant amount at the end of the reporting period is 200 rubles. The personal account balance has not changed.

At the beginning of the next reporting month, no funds will be debited from the linked bank card. No payment receipt will be generated.

The personal account balance at the beginning of the reporting period is 0 rubles.

During the reporting period, the account was topped up by 0 rubles.

The grant amount is 1,000 rubles.

The billing threshold is 2,000 rubles.

At the end of the reporting period, the amount for consumed resources is 2,300 rubles. The billing threshold has not been reached and the grant has been fully spent.

Total amount: 2,300 - (0 + 0 + 1,000) = 1,300 rubles.

At the beginning of the next reporting period, 1,300 rubles are debited from the linked bank card. A payment receipt will also be generated for 1,300 rubles.

Payment receipt details

| Name | Description |

|---|---|

| Recipient name | Name of the payment recipient company |

| TIN | TIN of the payment recipient company |

| Receipt date | Receipt closing date and time |

| № | Unique receipt number |

| Shift No. | Shift number |

| Service name | Information about the services provided |

| VAT | Tax rate |

| VAT amount | Amount of taxes paid for all lines of the receipt |

| Total | Amount, in rubles, the receipt was generated for, including VAT |

| Payment method | Settlement type and payment method |

| CR No. | Registration number of the cash register |

| FMD No. | Number of the fiscal memory device |

| FD No. | Number of the fiscal document |

| FA | Fiscal attribute of the document |

| Recipient's email address | E-mail address of the payment recipient |

| Payer's email address | Email address of the payer |

| FTS website | Website of the Federal Tax Service of Russia where you can check out the fiscal attributes |